nj property tax relief fund 2020

Mar 08 2022 TRENTON NJ. AP New Jersey Democratic Gov.

As Murphy Budget Soars To Record High N J Should Be Ready For A Recession Lawmaker Says Nj Com

Local Property Tax Forms.

. Fifty percent of payroll tax payments for 2020 will be due in 2021 with the other 50 due in 2022. Ad No Money To Pay IRS Back Tax. 5227D-439 Energy Tax Receipts Property Tax Relief Fund 2.

Besides education property taxes in NJ also fund. Average bill more than 9000. Local Property Tax Relief Programs.

Homeowners should also be provided a way to pay their property taxes on a monthly basis to prevent large lump-sum obligations from piling up the report said. Capital gains on the sale of a principal residence of up to 250000 if single and up to 500000 if marriedcivil union couple. Employer payroll taxes were deferred for 2020.

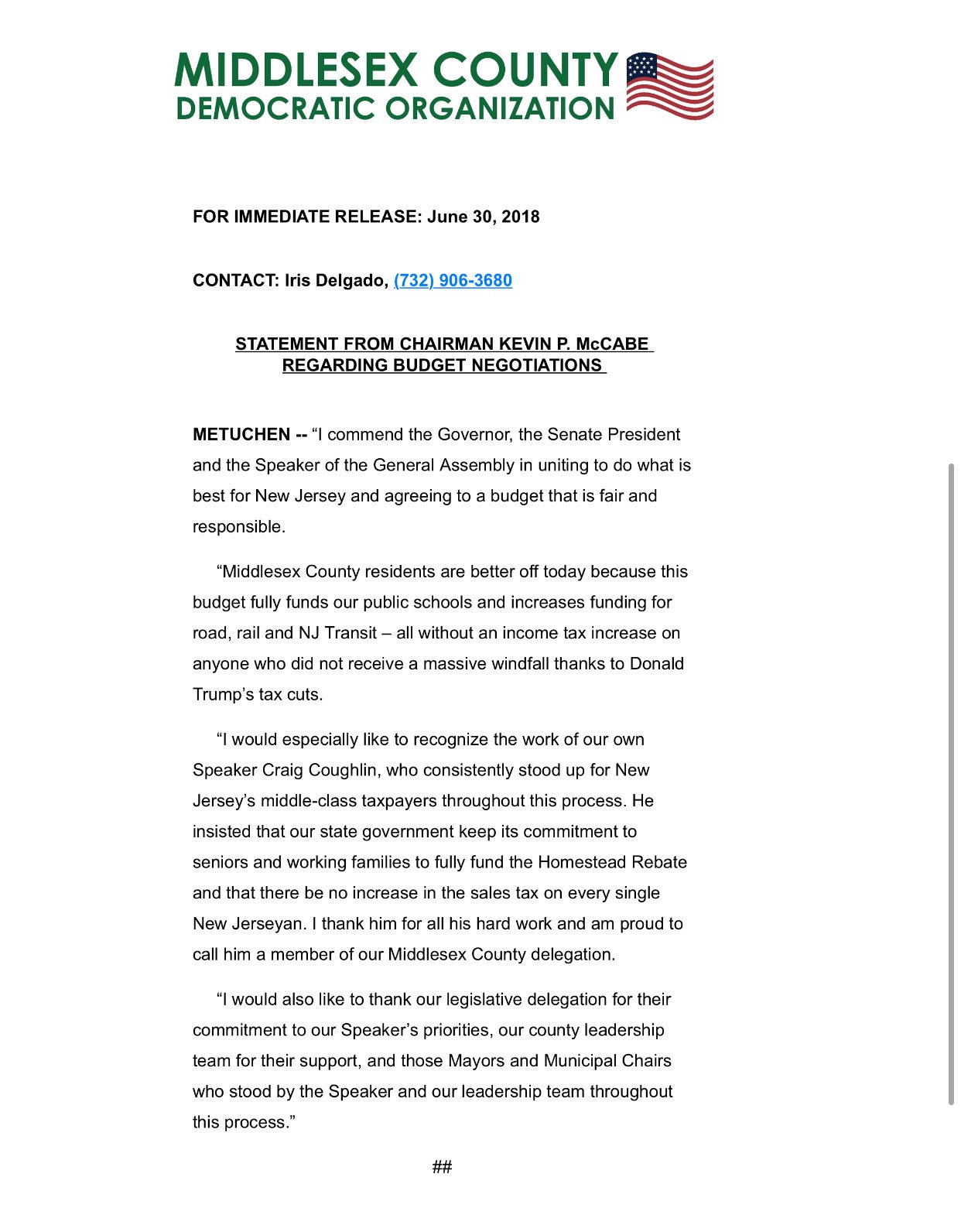

Phil Murphy proposed a 489 billion budget on Tuesday. For 870000 homeowners with incomes up to 150000 it would mean savings up to 1500 and 290000 households with incomes between 150000 and 250000 would get 1000 in tax relief. Moneys in the Property Tax Relief Fund shall be annually appropriated pursuant to formulas established from time to time by the Legislature to the several counties municipalities and.

New Jerseys Property Tax. The main reasons behind the steep rates are high property values and education costs. Nj property tax reduction.

You were domiciled and maintained a primary residence as a homeowner or tenant in New Jersey during the tax year. Allowing homeowners to defer their property taxes can also help address situations where rising home values have. Pritzkers Family Relief Plan also includes several tax holidays and rebates including a suspension of the states sales tax on groceries from July 1 2022 through June 30.

Civil Union Act Implementation. Taxes collected under the provisions of this act shall be deposited by the State Treasurer in a special account to be known as the Property Tax Relief Fund. 09 2020 5 New Jersey homeowners will not receive Homestead property tax credits on their Nov.

Commencing July 1. ANCHORs direct property tax relief reba. NJ property taxes climbed again in 2020.

So any personal income tax refunds come out of the Property Tax Relief Fund. The ERA creates a package of tax incentive financing. Phil Murphy s proposed 324 billion spending plan includes 275 million for the property tax relief program which lowers tax bills.

Capital gains in excess of the allowable exclusion must be included in income. If you were in the program prior to the move and received a reimbursement for the last full tax year you occupied your previous home you may qualify for the 2-year exception. To put this in perspective the average NJ citizen paid approximately 8861 in taxes in 2019.

County and municipal expenses. Call the Senior Freeze Information Line at 1-800-882-6597 for more information. Governor Phil Murphy signed the New Jersey Economic Recovery Act of 2020 ERA into law on January 7 2021.

In New Jersey localities can give. The plan boosts K-12 funding by 650 million makes a full public pension payment for the second straight year redistributes nearly 1 billion in property tax relief and raises overall spending by about 5 over last years plan. You are eligible for a property tax deduction or a property tax credit only if.

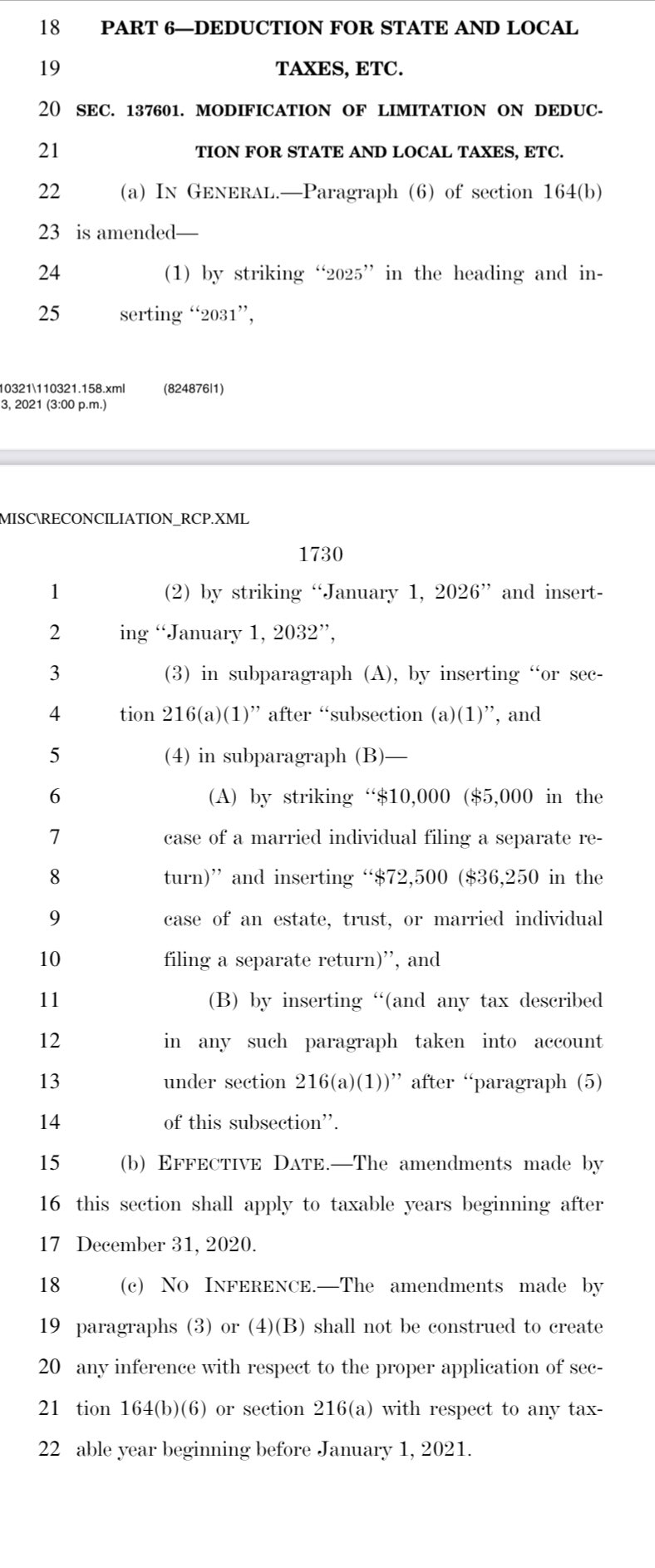

Your primary residence whether owned or rented was subject to property taxes that were paid either as actual property taxes or through rent. Murphy expanded the cap on the tax deduction in 2018 lifting it from 10000 to 15000. Capital gains and the exclusion of all or part of the gain on the sale of a principal residence are calculated in the same manner for.

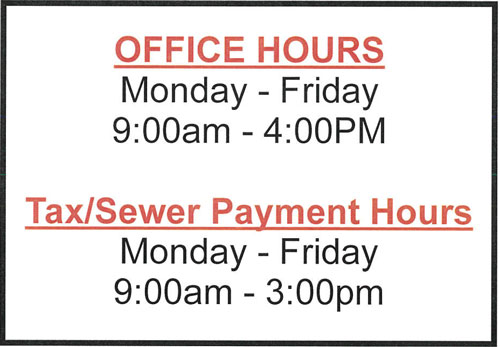

Forms are sent out by the State in late Februaryearly March. We will begin mailing 2021 applications in early March 2022.

500 Tax Rebates Which New Jersey Residents Will Receive The Money As Usa

Cash Rich States Are Slashing Taxes Amid Revenue Windfalls

Butler Calls Out Ridiculous Failings Of Property Tax Relief Task Force

Anchors Aweigh Explaining Governor Murphy S New Property Tax Relief Program New Jersey Policy Perspective

Borough Of West Wildwood Small Town Charm On The Back Bay

Senate Democrats Beat Back Gop Efforts To Further Cap N J Property Tax Break Nj Com

Anchors Aweigh Explaining Governor Murphy S New Property Tax Relief Program New Jersey Policy Perspective

500 Tax Rebates Which New Jersey Residents Will Receive The Money As Usa

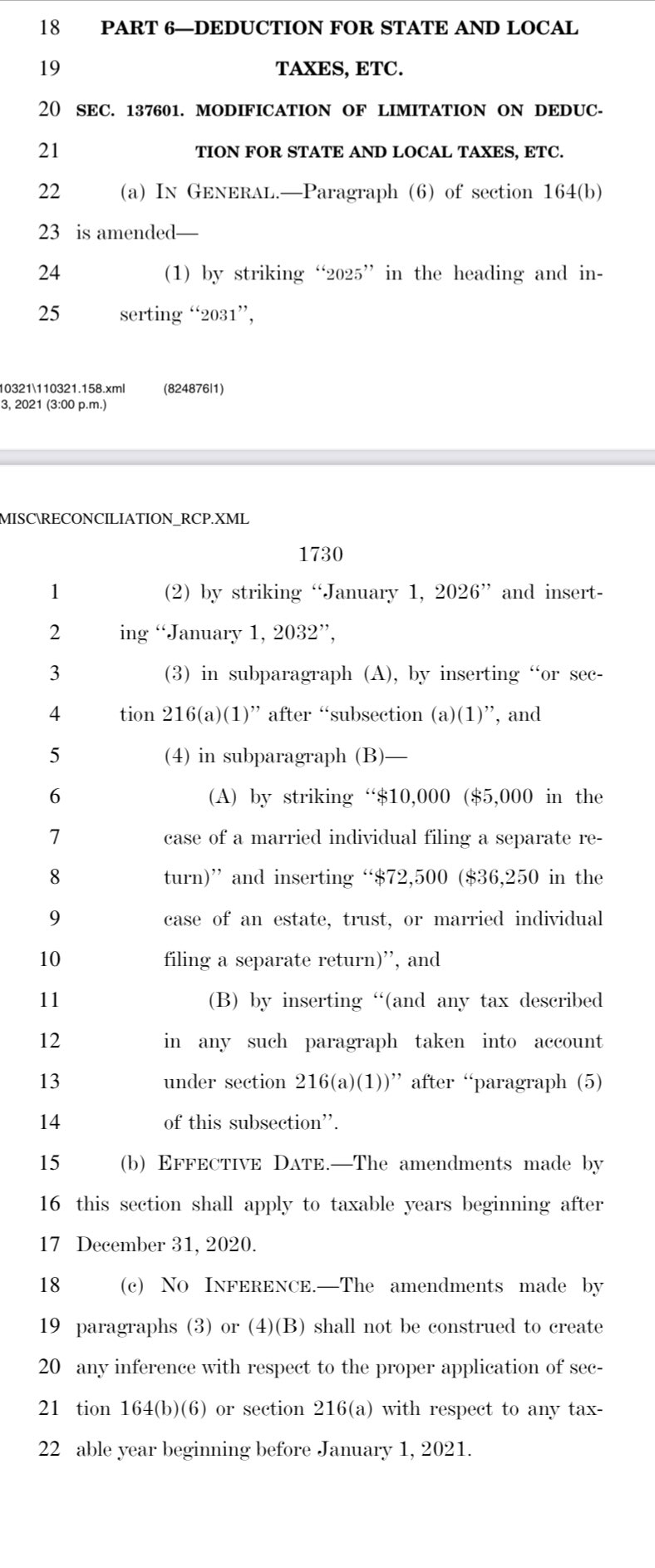

What Proposed Salt Changes Could Mean For Your Next Tax Bill Vox

2020 Senior Freeze Property Tax Reimbursement Program Allendale Nj

Cash Rich States Are Slashing Taxes Amid Revenue Windfalls

New Jersey Retirement Tax Friendliness Smartasset